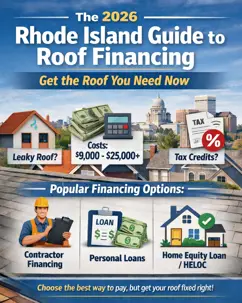

A roof replacement is one of the most important investments you will make in your home. In 2026, many Rhode Island homeowners see roof replacement costs that commonly fall in the $9,000 to $25,000+ range depending on roof size, complexity, ventilation needs, and material choice.

For families in Warwick (02886), Cranston (02921), and Providence (02906), paying that in one lump sum is not always the best move for a monthly budget.

This guide explains the most common ways homeowners finance a roof in Rhode Island, what to ask before you sign, and how tax credits may (or may not) apply. (This is general information, not tax advice. Always confirm details with your lender and a tax professional.)

Step 1: Start with the right mindset (cash flow vs. total cost)

Financing is not just about “Can I get approved?” It is about balancing: - Monthly payment you can comfortably afford - Total cost over time (interest + fees) - Speed (how quickly you can schedule the work) - Flexibility (early payoff, refinancing later, etc.)

If your roof is actively leaking or you have storm damage, speed matters. If your roof is aging but stable, you may have more time to shop rates.

Step 2: Know the main roof financing options in Rhode Island

There is no single best option for every homeowner. Here are the most common paths.

Option A: Contractor financing (fast and convenient)

Many homeowners choose contractor financing because it is simple: you apply, get an approval decision, and can move forward quickly.

Common structures include: - Deferred payments (for example, no payments for a set period) - Promotional low-interest offers - Longer-term fixed monthly payments

What to ask before you sign: - Is the rate promotional, and if so, what happens when the promo ends? - Is there a “deferred interest” clause (interest accrues and is charged later if not paid off in time)? - Are there origination fees or closing costs? - Is there a prepayment penalty?

Good fit for: - Homeowners who want speed and a simple process - Storm-related repairs where timing matters

Option B: Personal loans (no collateral)

A personal loan is typically unsecured, meaning it does not use your home as collateral.

Pros: - No lien on the home in many cases - Fixed payments can be predictable

Cons: - Rates can be higher than home equity products - Approval and rates depend heavily on credit and income

Good fit for: - Homeowners who do not want to use home equity - Smaller projects or partial roof work

Option C: Home equity loan or HELOC (often lower rates)

Home equity products can offer competitive rates because the loan is secured by your home.

Common types: - Home equity loan: fixed amount, fixed payment - HELOC (home equity line of credit): revolving line, often variable rate

Pros: - Often lower rates than unsecured loans - Longer terms can reduce monthly payments

Cons: - Longer approval process - Closing costs may apply - Your home is collateral

Good fit for: - Homeowners with strong equity and stable income - Larger projects (roof + gutters + insulation, etc.)

Step 3: Understand “0%” and deferred payment offers

You will often see offers like “0% for 12 months” or “0% for 18 months.”

These can be great tools when used intentionally, especially if you have cash available but prefer to keep it in savings for flexibility.

Key questions: - Is it truly 0% interest, or is it deferred interest? - What is the minimum monthly payment? - What happens if you miss a payment? - What is the interest rate after the promotional period?

Practical tip: If you choose a 0% promotional plan, set a payoff plan from day one. Divide the financed amount by the promo months and aim to pay that each month so you are not scrambling at the end.

Step 4: Rhode Island programs and local resources (how to evaluate them)

Some Rhode Island homeowners may qualify for local or state-supported programs depending on income, property type, and municipality.

Because program availability and requirements can change, treat any program as “verify current details” before relying on it.

How to evaluate a local program: - Who is the lender or administrator? - What is the interest rate range and term? - Are there income limits or property requirements? - Is the roof considered an eligible “essential repair”? - What documentation is required (estimates, permits, contractor registration, etc.)?

If you are in Warwick, Cranston, or Providence, ask your contractor for a written scope and line-item estimate. Many programs require clear documentation.

Step 5: The 2026 tax credit landscape (general guidance)

Tax rules change, and eligibility depends on the exact product and how it is installed.

General guidance: - Standard asphalt shingles often do not qualify for federal energy tax credits by themselves. - Some related upgrades may qualify, such as certain insulation improvements or qualifying energy-efficient products.

If you are considering energy-related upgrades as part of a roofing project, ask for: - Manufacturer documentation - Product model numbers - A clear invoice that separates eligible items

Important: This is not tax advice. Confirm eligibility with a tax professional.

Step 6: What to ask any contractor (financing + scope)

Financing only helps if the scope is correct.

Ask these questions: - What exactly is included (tear-off, underlayment, ventilation, flashing, drip edge, cleanup)? - Is ventilation included, and how is it being calculated? - What warranties apply, and what conditions can void them? - What is the estimated timeline from contract to install? - Can you show photo documentation of the current issues?

Quick comparison table (high level)

Option | Best for | Typical term | Notes |

|---|---|---|---|

Contractor financing | Speed and convenience | 12 to 120 months | Ask about promo terms and fees |

Personal loan | No collateral | 2 to 7 years | Rates depend on credit |

Home equity loan / HELOC | Often lower rates | 10 to 20 years | Uses home as collateral |

What to do next (Rhode Island homeowner checklist)

- Decide your target monthly payment range

- Gather 1 to 2 quotes with clear, line-item scope

- Compare financing offers using APR, fees, and total cost

- Ask about ventilation and flashing (common leak drivers)

- If you plan to claim any credit, confirm eligibility with a tax professional

Schedule a roof check and get a clear scope

If you are in Warwick, Cranston, or Providence and you want a clear plan (before you choose financing), we can document roof condition and help you understand the scope.

Call/text (401) 425-4108.

FAQ

Can I finance a roof in Rhode Island with bad credit?

In many cases, yes. Some lenders offer options for lower credit scores, but interest rates and terms can vary widely. The best step is to compare offers and focus on the total cost, not just the monthly payment.

Are roof loans tax-deductible in Rhode Island?

Some interest may be deductible in certain situations (for example, when a home equity loan is used for substantial home improvements). Tax rules vary by situation and can change, so confirm with a tax professional.

Rhode Island Service Locations:

Ashaway, Barrington, Bradford, Bristol, Carolina, Central Falls, Charlestown, Chepachet, Clayville, Coventry, Cranston, Cumberland, East Greenwich, East Providence, Exeter, Forestdale, Foster, Glendale, Greene, Greenville, Harrisville,Hope,Hope Valley, Hopkinton, Jamestown, Johnston, Kenyon, Kingston, Lincoln, Little Compton, Manville, Mapleville, Middletown, Narragansett, Newport, North Kingstown, North Providence, North Scituate, North Smithfield, Oakland, Pascoag, Pawtucket, Portsmouth, Providence, Riverside, Rockville, Rumford, Saunderstown, Shannock, Scituate, Slatersville, Smithfield, Tiverton, Wakefield, Warren, Warwick, West Greenwich, West Kingston, West Warwick, Westerly, Wood River Junction, Woonsocket, Wyoming

Last updated: 2026